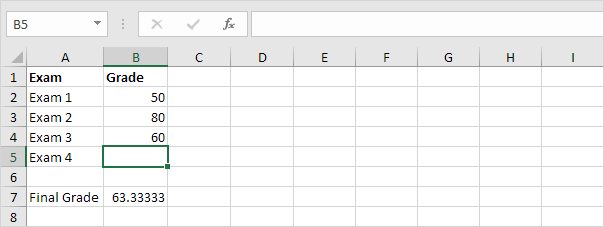

Goal Seek attempts to come up with a solution that is an exact match to the target value.Īt the end of the process, the Goal Seek pop-up window changes to a Goal Seek Status window, stating whether or not a solution was found, and a preview of the result is shown in the worksheet. The third field (By changing cell) refers to the cell that you would like Excel to adjust (B1) in order to arrive at the desired result.Īfter selecting OK, Excel will work backward to calculate the income required to allow 10% savings. In the ‘To value’ field, enter the desired outcome (10%). In ‘Set cell’, enter the cell reference, which will contain your desired result (in our case, B15). We will use Goal Seek to arrive at the required income value.Īfter selecting the Goal Seek command, a pop-up window will appear. But to how much?īy using the Goal Seek command, we can indicate a desired outcome, and Excel will determine the adjustment we need to make to a single variable. If you would like your savings to be 10% of your income, and assuming that you are unable to reduce your expenses, you realize that you must increase your income.

Your savings (B14) are shown as the difference between the two and displayed as a percentage of your income in cell B15.

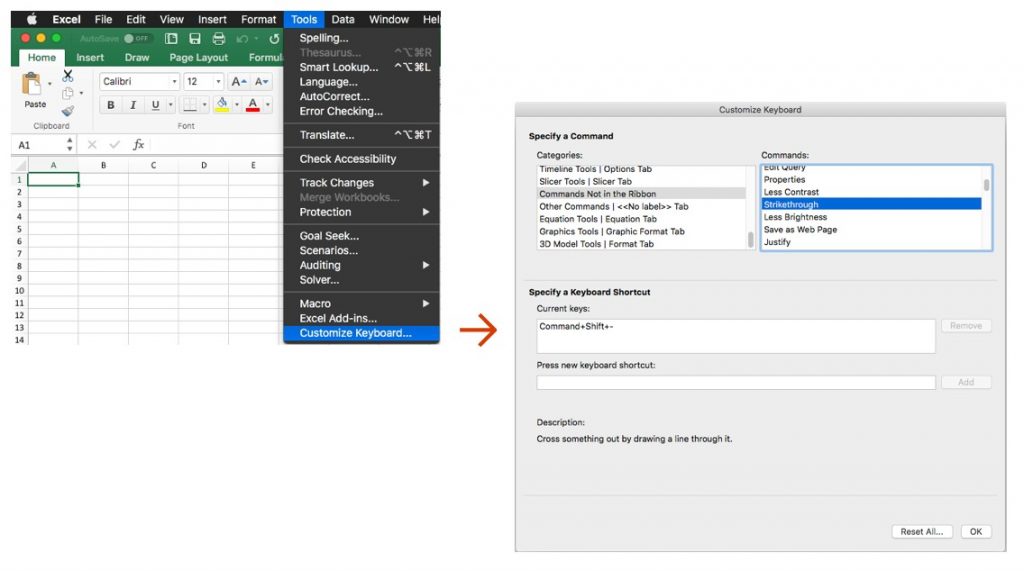

#Goal seek on excel for mac for mac#

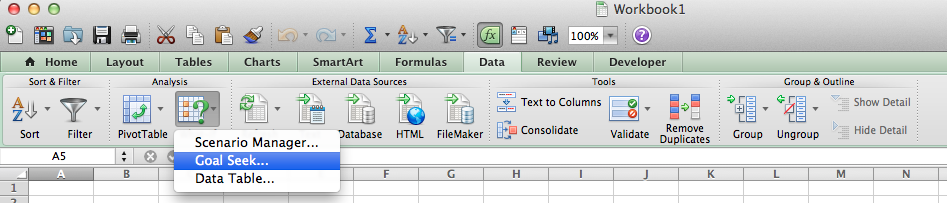

In Excel for Mac 2011: On the Data tab, in the Data Tools group, click What-If Analysis, and then click Goal Seek.To illustrate how it works in a simple example, imagine that cell B1 (below) displays your monthly income, and cells B3 to B11 shows your expenses. In Excel 2016 for Mac: On the Data tab, click What-If Analysis, and then click Goal Seek. For more information, see Define and solve a problem by using Solver. If you want to accept more than one input value, for example, both the loan amount and the monthly payment amount for a loan, use the Solver add-in. Note: Goal Seek works only with one variable input value. In the example, this reference is cell B3. In the By changing cell box, enter the reference for the cell that contains the value that you want to adjust. Note that this number is negative because it represents a payment.

In the To value box, type the formula result that you want. In the example, this reference is cell B4. In the Set cell box, enter the reference for the cell that contains the formula that you want to resolve. On the Data tab, in the Data Tools group, click What-If Analysis, and then click Goal Seek. Use Goal Seek to determine the interest rate The formula divides the value in B3 by 12 because you specified a monthly payment, and the PMT function assumes an annual interest rate.īecause there is no value in cell B3, Excel assumes a 0% interest rate and, using the values in the example, returns a payment of $555.56. The formula also refers to cell B3, which is where you will specify that Goal Seek put the interest rate. The formula refers to cells B1 and B2, which contain values that you specified in preceding steps. You don't enter that amount here, because you want to use Goal Seek to determine the interest rate, and Goal Seek requires that you start with a formula. In this example, you want to pay $900 each month. This formula calculates the payment amount. Next, add the formula for which you have a goal. Instead, you add the formula to the worksheet and specify the payment value at a later step, when you use Goal Seek. Note: Although you know the payment amount that you want, you do not enter it as a value, because the payment amount is a result of the formula. This is the number of months that you want to pay off the loan. This is the amount that you want to borrow. Prepare the worksheetįirst, add some labels in the first column to make it easier to read the worksheet. In this example, the monthly payment amount is the goal that you seek. The PMT function calculates a monthly payment amount. Let's look at the preceding example, step-by-step.īecause you want to calculate the loan interest rate needed to meet your goal, you use the PMT function. If you want to accept more than one input value for example, both the loan amount and the monthly payment amount for a loan, you use the Solver add-in.

0 kommentar(er)

0 kommentar(er)